ORANGE (ORAN)

Alert: Rating Downgrade (5/1/24)-ORANGE (NYSE: ORAN).

Stock Rating Downgrade

The Value Trend Rating for ORANGE (NYSE: ORAN) weakened recently from B to C reflecting eroding fundamentals and low Appreciation Potential. Details supporting this lower rating are included in our next report.

Recent Price Action

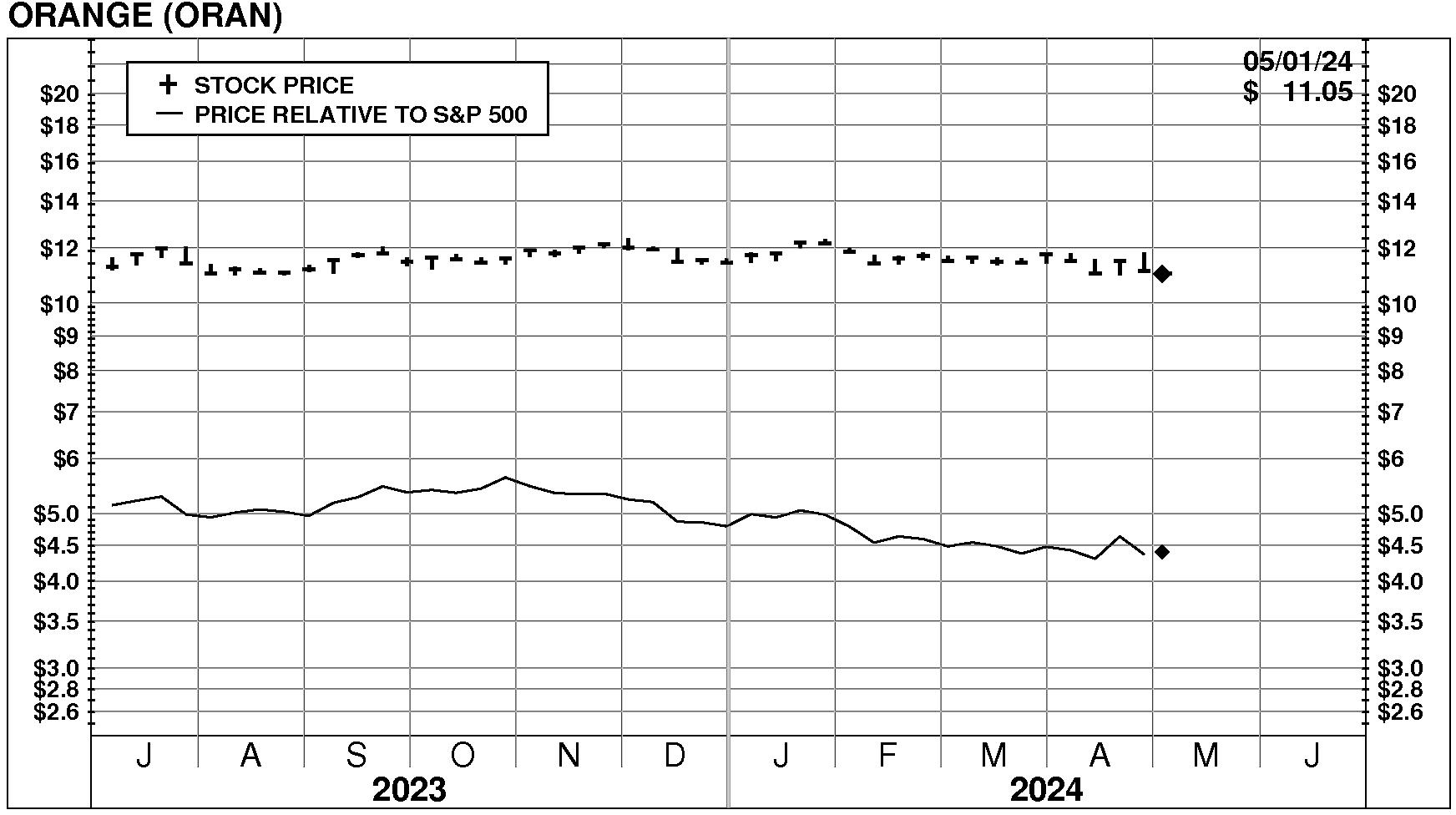

On 5/1/24, ORANGE (NYSE: ORAN) stock declined slightly by -0.4%, closing at $11.05. However, this decline was accompanied by unusually low trading volume at 62% of normal. The stock has declined -5.2% during the last week and has performed in line with the market over the last nine months.

Current PriceTarget Research Rating

ORAN's future returns on capital are forecasted to exceed the cost of capital. Accordingly, the company is expected to continue to be an important Value Builder.

ORANGE has a current Value Trend Rating of C (High Neutral). This rating combines very contradictory signals from two proprietary PTR measures of a stock's attractiveness. ORANGE has a very high Appreciation Score of 86 but a slightly negative Power Rating of 35, producing the High Neutral Value Trend Rating.